RHEA agent-based housing market model

- Combines the strengths of traditional hedonic analysis with social interactions, learning, and adaptive behavior of heterogeneous households that ABMs offer

- Download the Model Open Access Code (+ODD description)

- Read the article in Environmental Research Letters

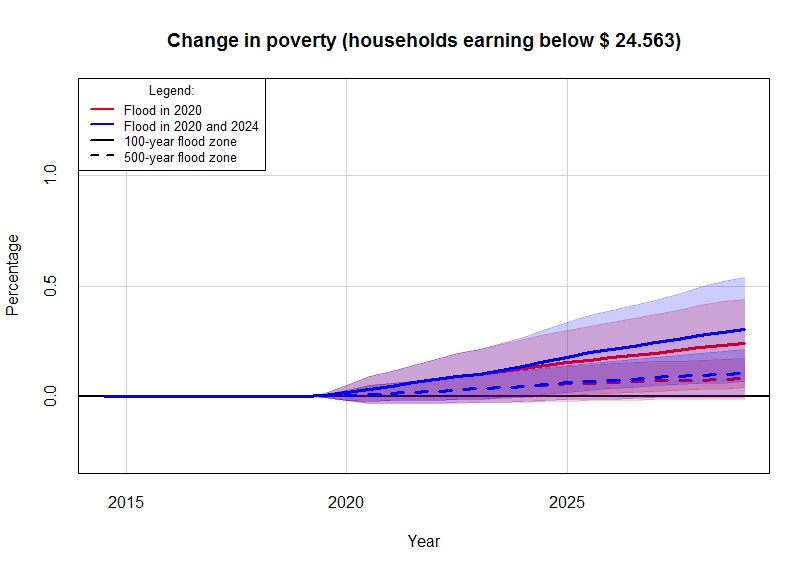

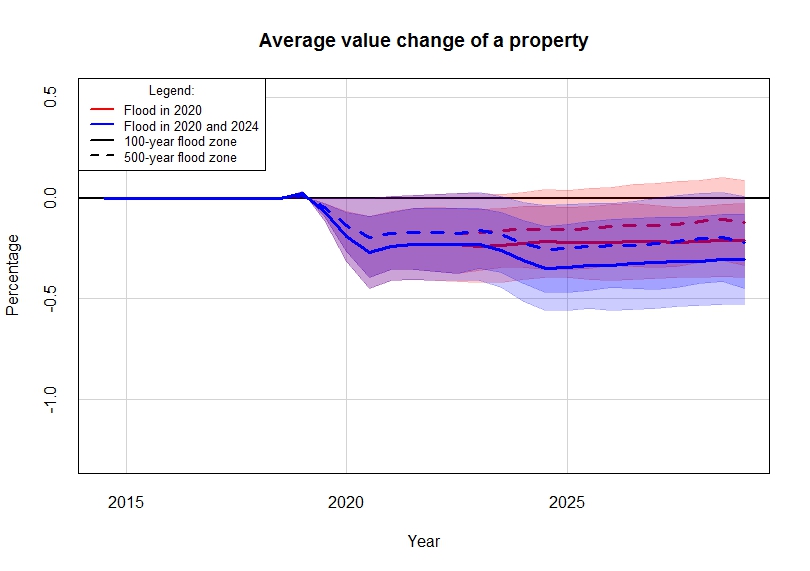

RHEA simulates the aggregated impacts of households’ residential location choices and their changing risk perceptions in response to flooding. One can explore the effects of climate change on urban resilience under various assumptions on how people behave when facing risks.

Real housing transaction prices and the 2018 survey data among buyers and sellers from US flood flood-prone cities strengthen the rules of agents actions and interactions, which are grounded in behavioral theories. Adaptive behavior of agents, their learning about flood risks, and the formation of price expectations are supported with Bayesian learning based on real data.

We find that when floods intensify affecting large urban areas, prices do not recover after a flood as they usually do currently. These pure market-driven processes can cause shifts in demographics in climate-sensitive hotspots placing low-income households further at risk. Low-income households cannot always move away due to mortgage debts and get trapped in hazard zones, suggesting increasing climate gentrification as an outcome of market sorting